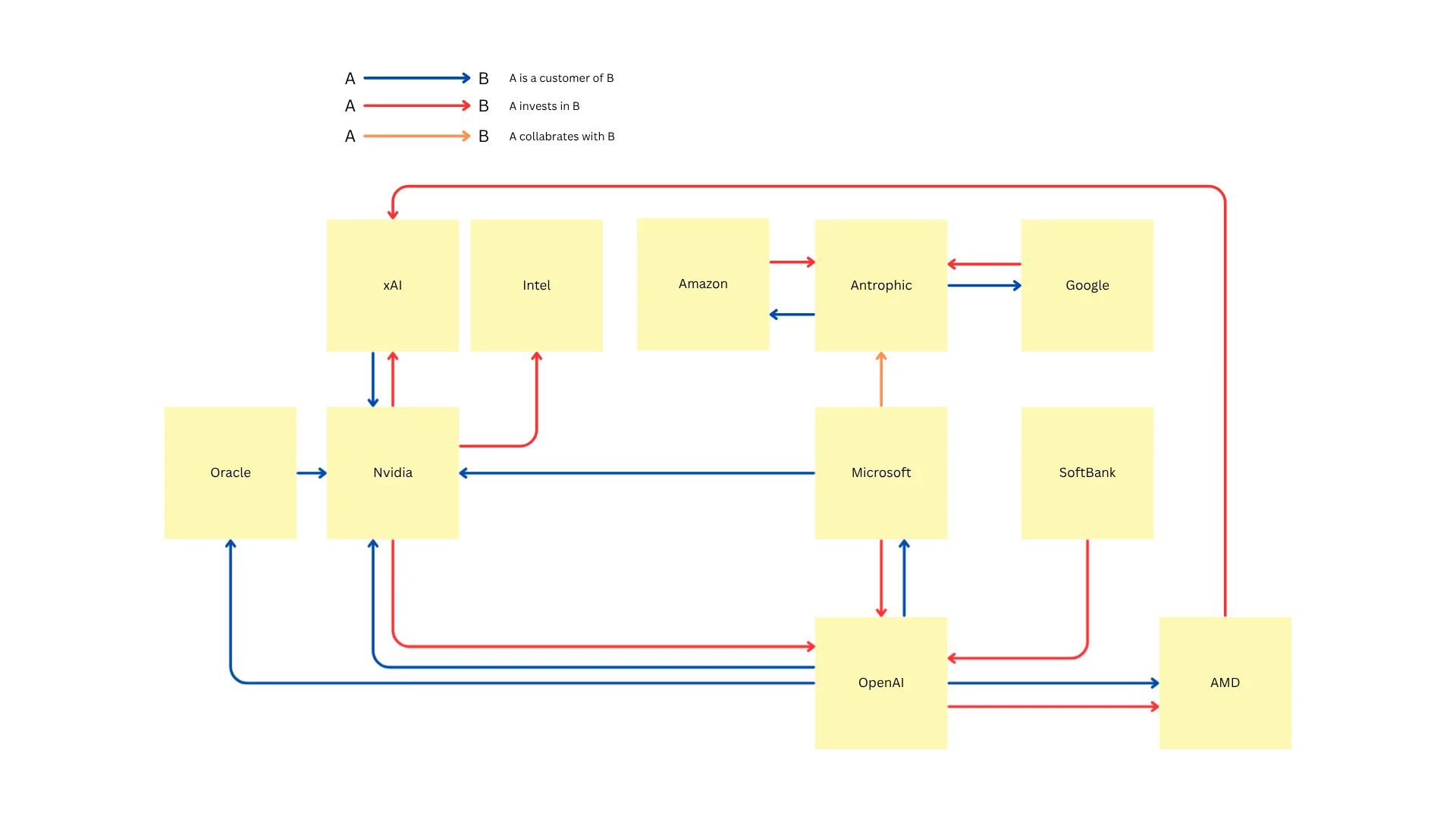

The landscape of artificial intelligence (AI) has become increasingly complex, characterized by interwoven relationships between AI companies and their key vendors. This intricate web is exemplified by the recent developments involving major players like Oracle, Nvidia, and OpenAI. As these relationships evolve, they reveal a significant circular dynamic that could skew the market for years to come.

OpenAI money goes around and around

Oracle’s announcement of a staggering $300 billion contract to build AI data centers highlights the investments being made to fuel the AI industry. Among these facilities, one is designated for OpenAI, the frontrunner in AI development today. This begs the question: where does OpenAI secure its funding? The answer lies in partnerships with companies like Nvidia, which has placed itself at the heart of the AI “gold rush.”

Nvidia money in OpenAI

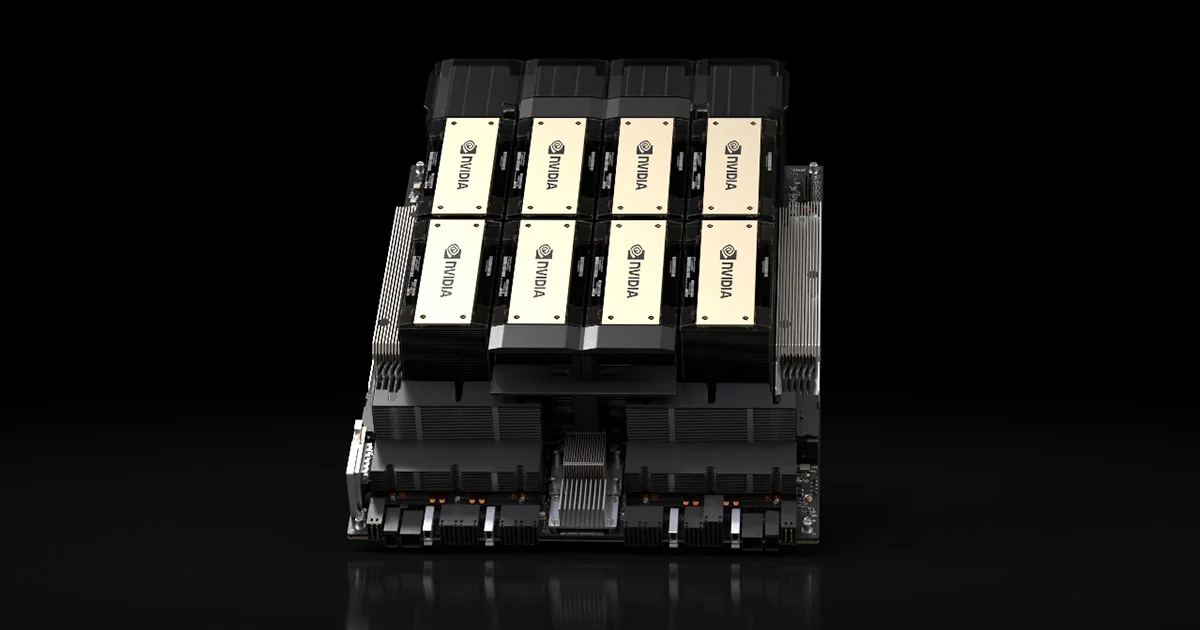

Nvidia’s role in this ecosystem is reminiscent of a Californian gold miner’s supplier during the Gold Rush. Samuel Brannan, the state’s first millionaire, amassed his wealth by selling crucial supplies to miners. In today’s context, Nvidia serves a similar purpose, providing the essential hardware—specifically, GPUs—that nearly every AI company relies on to power their models. As a result, Nvidia has become the “shovel” in this new frontier, dominating the market for graphics processing units critical for AI development.

Moreover, Nvidia’s influence extends beyond hardware. The company has strategically invested in various enterprises to secure its position within the AI ecosystem. Its public holdings include companies like CoreWeave, an AI cloud computing provider, and Nebius Group, which specializes in AI infrastructure. Nvidia has also backed promising startups such as OpenAI, where it plans to invest progressively, totaling $100 billion to support the construction of their data centers.

Contrastingly, OpenAI exemplifies the modern AI titan, having raised billions from high-profile investors, including Microsoft, SoftBank, and various venture capital firms. OpenAI’s ambitious Stargate Project aims to build $500 billion in AI infrastructure over the next four years, further solidifying its stature in the industry. This web of relationships creates a situation where many investors in OpenAI also have stakes in competing companies, creating a complicated mesh where corporate interests overlap. For instance, while Microsoft invests in OpenAI, it also partners with competing AI companies like Anthropic, and AMD invests in Elon Musk’s xAI venture, highlighting the contradictory nature of these relationships.

The relationship about to get circular

This circular relationship fosters a market environment where revenue streams are dependent on interconnections between companies and their vendors. AI companies become not only competitors but also clients and collaborators of one another, creating an ecosystem prone to instability. As clients, can companies like Microsoft prioritize their investments in AI ventures over potential competition? Such arrangements can distort market dynamics, leading to biased technology development and reinforced monopolistic tendencies.

The reality is that the AI sector appears to be in a bubble, a sentiment echoed by various experts. While the technology promises transformative benefits, the interplay between key players—like Nvidia, OpenAI, and their investors—raises concerns about sustainability. The question remains not if this bubble will burst, but rather when it will do so. Predicting the timing of such an occurrence is inherently challenging, compounded by the intricate relationships that have been established.

Conclusion

In conclusion, the circular relationship between AI companies and their vendors creates a landscape ripe for potential market snafus. As interdependencies strengthen, the risk of bias, market manipulation, and unsustainable growth increases. The intricate ties among key players distort competitive dynamics and could lead to severe market fluctuations once the bubble bursts. Navigating this complex ecosystem will require keen awareness and strategic foresight to mitigate the risks that accompany such deep-seated interrelations. As the industry continues to evolve, the onus is on stakeholders to foster a fairer marketplace that prioritizes innovation over mere consolidation of power.

Plug

Support this free website by visiting my Amazon affiliate links. Any purchase you make will give me a cut without any extra cost to you

| Base | Pro | |

|---|---|---|

| iPhones | iPhone 16 / iPhone 16 Plus - (Amazon) | iPhone 17 Pro / iPhone 17 Pro Max - (Amazon) |

| iPhone Accessories | Find them at Amazon | |

| Watch | Apple Watch SE (Amazon) / Apple Watch Series 11 | Apple Watch Ultra 3 (Amazon) |

| AirPods | AirPods 4 (Amazon) | AirPods Pro 3 (Amazon) / AirPods Max (Amazon) |

| iPad | iPad 10 (Amazon) / iPad Mini (Amazon) | iPad Air M3 (Amazon) / iPad Pro M5 (Amazon) |

| Laptops | MacBook Air M3 (Amazon) | MacBook Pro M5 (Amazon) / MacBook Pro M4 Pro/ M4 Max (Amazon) |

| Desktop | Mac Mini M4 / M4 Pro (Amazon) / iMac M4 (Amazon) | Mac Studio / Mac Pro |

| Displays | Studio Display (Amazon) | Pro Display XDR (Amazon) |

Other Ecosystem Items