Supporters of cryptocurrency (crypto for short) will say crypto is not only the future of money, but the entire human civilization. Money no longer controlled by any government, which is the case since the first civilizations, so the true value of money will be finally unlocked. Meanwhile, professional economist, which some of the won actual Nobel prizes dismiss such notion about crypto, specifically Bitcoin will be the accepted form of money in the future.

This is a snapshot view of the state of crypto usage and most importantly acceptance in April 2020. We find out that a few major players has accepted crypto in their trading network, and if it will be the future of payments, that remains to be seen.

Plug: Audiable allows you to listen to your favorite books while on the go. Sign up today for a free 30-day trial. Click on the link below:-

Crash Course on Money

First, a little crash course about money, after all, crypto is all about money. Even the BitCoin paper mention that their solution is to keep track of transactions and to solve the double spending problem, which in turns records how much money is being spend.

What is money actually? We use it everyday to purchase goods and services, but what makes money, money? Money has the following properties: it is a medium of exchange (can be used to exchange goods and services), it is a unit of account (stack 100 $1 notes, then its value is $100) and it has stored value (the value does not significantly changes in a short time).

So in other words, money must be fungible (you can exchange $1 for another), durable, portable, uniform (US bank notes are consistent), limited in supply, acceptable and divisible (when you pay a soda with $100 bill, you can get the change). Crypto like Bitcoin fulfill can fulfill all of the requirements, but the main roadblock right now is the acceptance and store value issue. As Paul Krugman in his column talking about gold coins:-

Even when people relied on gold and silver coins, what made those coins useful wasn’t the precious metals they contained, it was the expectation that other people would accept them as payment.

– Paul Krugman

What this has to do with cryptocurrency?

For the crypto to be the future of money, it needs to have all the above features which has been highlighted before, acceptance and volatility is the current major issue. Volatility and acceptance sometimes goes hand in hand. To be accepted as a currency, bitcoin must not be volatile. To not be volatile, it must be accepted as a medium of exchange by a huge group of parties.

Crypto acceptance

As of April 2021, a few major companies beginning to accept crypto as a medium to settle debts. In other words, crypto is a good as currency in some cases. Tesla, after announcing that they invested $1.5 billion in bitcoin, is the first major company to accept Bitcoin as payment in purchasing their vehicles. When buying the car online, (even when you buy their car at their dealership, the sales associate will help you buy it online), you will presented with a choice to pay the car using cash or bitcoin. Thought, it is without some caveat: the purchase is only for US customers, bitcoin will not be converted into fiat money, the transactions must go through to the correct address, otherwise, the bitcoin could be lost forever.

Next on the list, is VISA, a major electronic transaction company, which we all know as credit cards. VISA has announced that it will accept cryptocurrency in its transactions. However, there is a caveat. It is not any cryptocurrency, but the USDC (US dollar coin cryptocurrency). Which each of the coin generated is backed by actual dollar. As of 2021, there is $11.3 billion backed in the crypto.

PayPal follow suite by announcing their platform can now buy, hold and sell select cryptocurrency. The selected cryptocurrency are BitCoin, Ethereum, Litecoin, and Bitcoin Cash. The caveat is that it is only available for US customers (except Hawaii), it does not facilitate trades or transactions using cryptocurrency and the annual buying limit is $50,000, which at current prices, less than a full BitCoin.

The US government is currently researching a way to introduce digital dollar. The Federal Reserve Bank of Boston, working together with researchers at Massachusetts Institute of Technology (MIT) will reveal the first stage of the road to digital dollar sometime in the 3rd quarter of 2021. There are many pathways to US government to adopt a cryptocurrency, but most people said that it will not look anything like the decentralized BitCoin.

Current issues

There are some issues with using Bitcoin at the moment. First and foremost, there is no recourse if anything goes wrong. With credit card and money transfer, you can trace the transfer to a person. Crypto like Bitcoin are annonymous by design. So if you accidently move your bitcoin to the wrong address, there’s almost no way to get that money back and in worst case scenario, it will be lost forever.

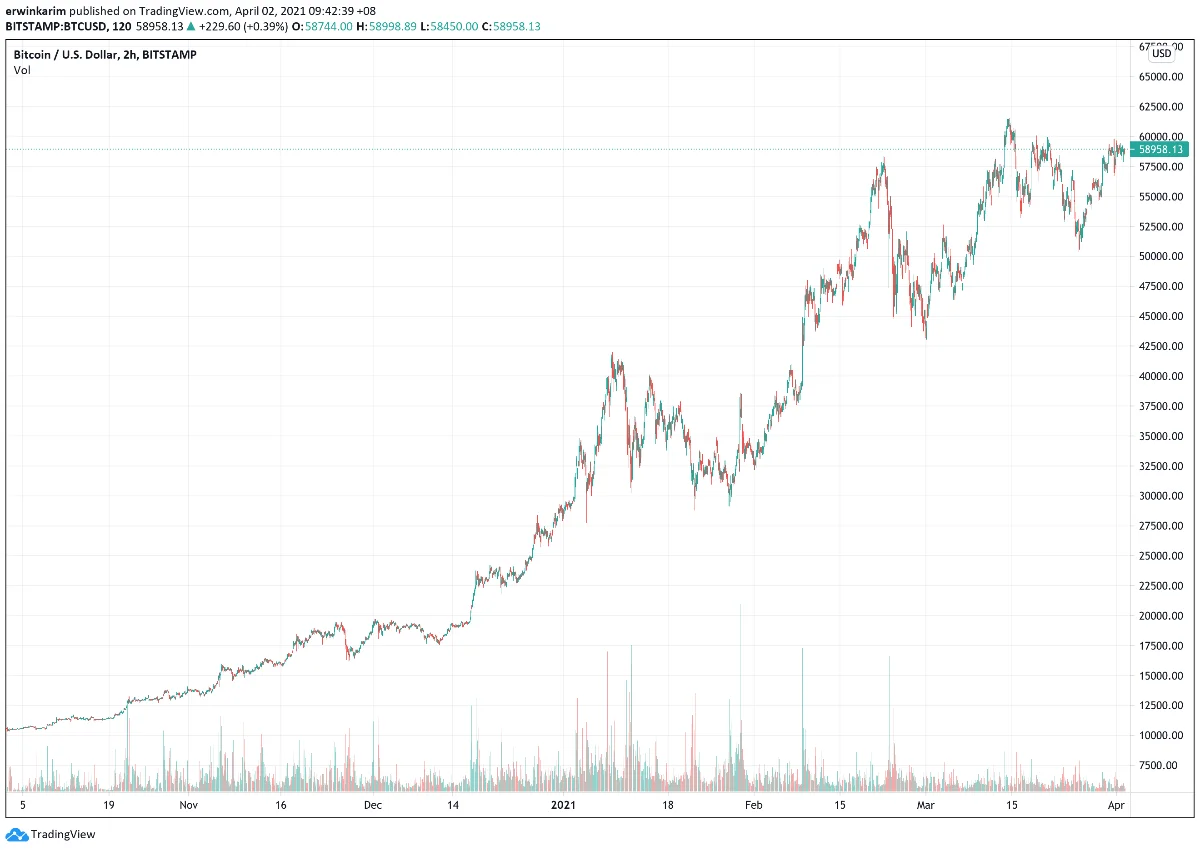

Another issue is the current volatility of bitcoin. The way bitcoin is designed is to have finite amount of coins in the network over time. This causes deflationary pressure which induce people to hoard bitcoin instead of spending it. Because of this deflationary design, most people view bitcoin as a speculative assets instead of medium of exchange that the creators of bitcoin intended.

Future trends

Now, a select few major companies has started to accept BitCoin as a medium of exchange and by all means, money. However, this is just the first step toward wide acceptance, if the future will be. BitCoin holdings, although in billions of dollars in assets represent just a drop of the bucket in trillions of dollars of global total asset value. The bad news, crypto like BitCoin is a long way from being the money of the future. The good news, its a long way from being the money of the future.

Now, with powerful governments like the United States are finding ways to jump of the bandwagon but in their terms, cryptocurrency is an idea that won’t go away anytime soon.

Plug

Help grow this site and my family by visiting my affiliate links below:-

Accessories:-