There are some ideas, once introduced, will never idea because it is so endearing. Ideas like peer to peer distribution, prime numbers, streaming services and the latest, Cryptocurrency are some that will never idea no matter what. Some might argue that cryptocurrencies like BitCoin is not really money, block chain is a fad and other new inventions that are laden with techno babble are really snake oil in disguise. However that maybe, cryptocurrency has now attracted the attention of the United States government and they might join the bandwagon, but just not in the way that you would think. This article explores the United States government involvement in money, commerce and their current and future endeavors with cryptocurrency.

Plug: Wondershare Filmora video editor for the Mac allows you to tell your story to the world.

What is the Dollar To The US Government

First, some definition of money and it uses in the eyes of the US government. Money, in the traditional sense, is a medium of exchange for transactional purpose in an economy. In layman terms, it is used to settle debts and the value how much something is worth. There are many uses of money, you can use it as a unit of account (to keep track of your income, spending and value of your assets + liabilities), a store of value (money is stable enough that your $100 today is worth something in the next 10 or 100 years), and standards of deferred payment (you pay your debts in it).

To the US government, money in general and the almighty US dollar in particular is a powerful tool. The US economy, in which the US national conducts its economic activities is run on the US dollar. And since the US is one of the largest economic entity in the world (in which the others large entity being the European Union and People’s Republic of China), the US dollar is one of the most powerful, if not the most powerful money in the world.

The US dollar showcase America’s hard and soft power through the globe. The US dollars is used in 15 other countries other than the United States. 22 foreign countries has fixed changed rate against the US dollar. In international trade, most goods are traded in US dollars. Oil, the most important commodity of the 20th and early 21th century is traded in US dollars.

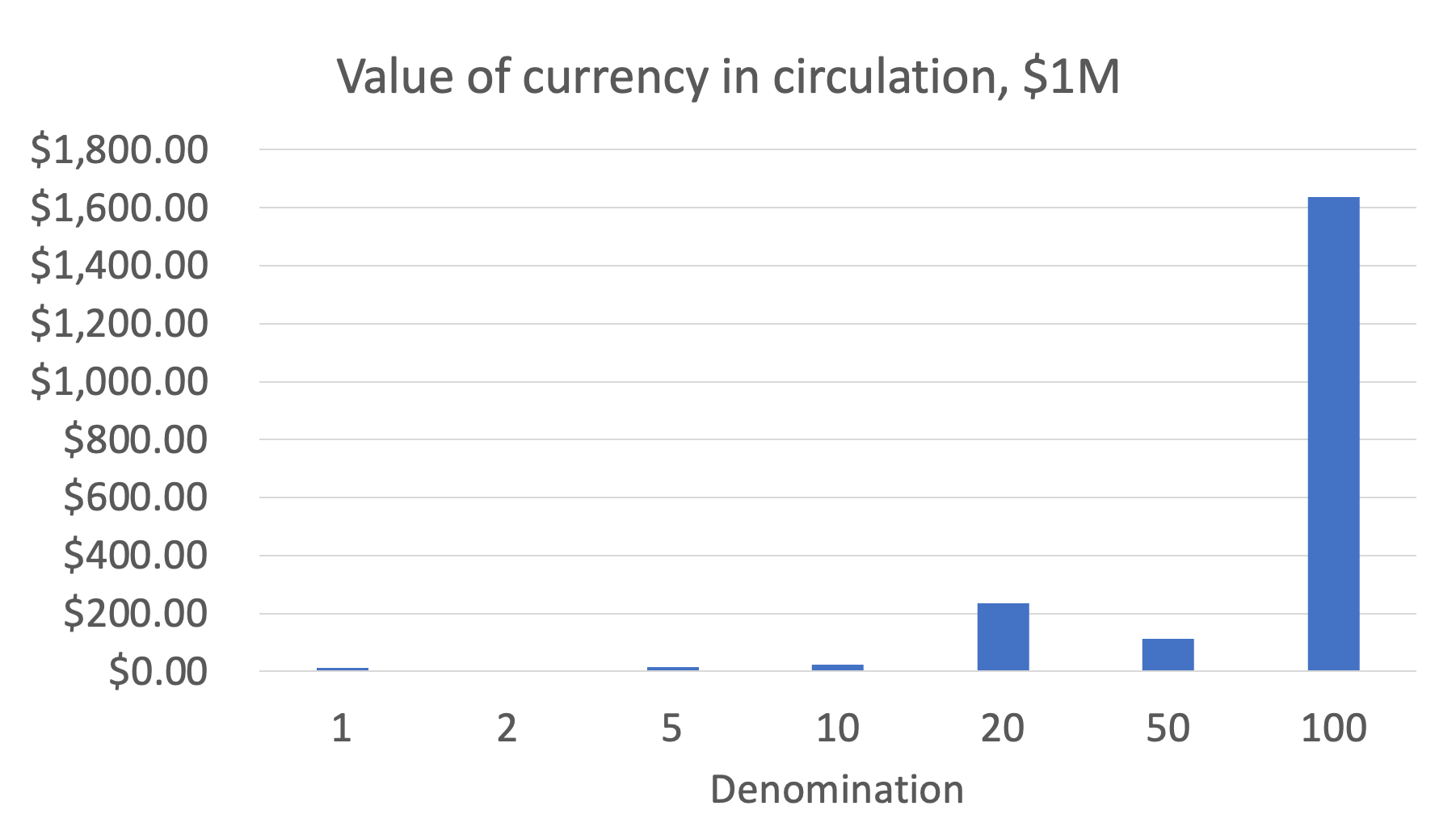

The US dollar also eschews US soft power. Over 25% of all dollar bills are $100 dollar bills and around 80% of all $100 dollar bills are in countries that is foreign of the United States. This shows that US dollar is in high demand through out the world and everyone is invested in the United States economy.

Motivation

So we have establish the importance of money in general. We also highlighted the importance of the US dollar in detailed and why the US dollar is very important to the US government. But why the US government is considering to enter the cryptocurrency bandwagon. What are the problems that a digital US dollar can solve?

Lower cost. Currently, it takes money to print money. It also cost money to maintain such money, to physically transport it to far away places and to secure it. Digital dollar can take care of such problems by putting everything on the wire. While the cost of printing money is just a few cents for every note (including the $100), but transporting and securing them in large amounts will have significant cost. Such cost is high enough that there are movements to eliminate the penny.

Tracking. While some privacy advocate would argue against this, there are legit reasons why the US government want to track transactions. The beauty of using fiat currency like the paper US dollar bill that it is theoretically untraceable. Money can exchange hands in some cases laundered from dirty money to clean money. With cryptocurrency and block chain technology that it is built upon, one can track where does every dollar went. By knowing who owns a particular ledger, one government can track suspicious activity. Of course this will be a double edge sword and no doubt, will have an endless debate about such tracking technology.

Taxation. Another reason why government would love to track where money goes is because of taxation. In the eyes of the US law, tax evasion is one of the most heinous crimes that you can commit. Not withstanding legal means, tax avoidance costs the US government approximately $1 trillion in lost revenue. Yes, that is in trillions. By keeping track how every dollar is spent, one government can easily track companies and individual for tax purposes.

Control. The US dollar continues to be one of USA’s power levers. Thinking about creating the digital equivalent of cryptocurrency for the US dollar shows that the idea has won over hearts and minds of many people, even people in government. However, US late entry into the cryptocurrency game should not be mistaken that the war is already over and BitCoin won, it is far from it. Bitcoin, the largest cryptocurrency in the world might have a market cap at over $1 trillion in May 2021, but there’s 20 trillion dollars in circulation (M2 money supply) as of April 2021 in which the US government can easily increase it.

Current Efforts

So the United States dollar is one of the most important currencies in the world and it is controlled by the United States government. The government has sent a series of signals that they are interested in created a digital cryptocurrency version of the US dollar, but they are not rushing to get it out. From their point of view, they rather be best in class than first in class.

On May 2021, one of the board members of the Federal Reserve Board (USA’s central bank), Dr. Lael Brainard has said that the US Federal Reserve is exploring the possibility of using the US dollar in digital form. However, there are major policy concerns needs to be addressed before such currency can be issued digitally.

This add context to the statements of the Federal Reserve chair, Jerome Powell, about updating US payment system to incorporating emerging technologies like block chain. Mr Powell also says that the Federal Reserve will also issue a discussion paper in summer 2021 about created a US digital coin.

MIT, one of the best universities in America and the world, has a collaboration project with Federal Reserve of Boston to study a design of a Central Bank Digital Currency (CBDC). The project was launched in October 2019 and expected to announce their results of the collaboration sometime in the summer of 2021.

Efforts In Other Nations

The United States is not the only country in the world who wanted to create their own digital currency. Bank of Japan has confirmed that they have started trials of Yen-based CBDC which slated to be started in March 2022. Basic functions of money like issuance, distribution and redemption will be tested on the 1-year trial.

The European Union (EU) has been exploring the use of Digital Euro and currently in the study phase. According to Fabio Panetta, one of the board members of Euro Central Bank, the digital Euro will meet the expectations of business and citizens of the EU and the main concerns is privacy.

China, while allegedly to be main driver of CBDC has released the digital version of their currency, the Yuan which unsurprisingly called digital Yuan. The digital currency has been tested since February 2021 via state own commercial banks. In the trials, around 50,000 people receive 200 Yuan ($30) and able to use the money at designated offline or e-commerce website.

The Future

Central Bank Digital Currency or Sorveign Coin is just a continuation of how we use money. Money might started with some rare items like seashells in the interior jungles of Amazon to rare commodity like gold and now with government backed paper notes. Digital currency where a central bank of the government issue the coins is just a continuation of this trend.

With just 4 major economic blocks, US, EU, Japan and China represents almost 70% of the world’s economic output. With their early foray and studies into CBDC, it can be assured that digital coin or cryptocurrency is now no longer a matter of if, but when. The world would not be using BitCoin for trading, but CBDC through laws and enforcement.

Plug

Help grow this site and my family by visiting my affiliate links below:-

- Apple USB-C 20W charger - Amazon

- AirPods

- iMac - Buy at Amazon

- MacBook Air M1 - Buy at Amazon

- MacBook Pro M1 13" - Buy at Amazon

- Macbook Pro 16" - Buy at Amazon