On 21 March 2024, the Department of Justice in the USA filed a lawsuit against Apple Inc for anti-competitive behavior. Dominating market share because your product is that good and your company is that well run is one thing, but securing your monopoly by killing your competitors, the DoJ has a problem with that.

We read through the lawsuit and here’s what we understand. The main theme is that Apple is forcing users to stay on their #1 product, the iPhone by making it hard for competitors to put in alternatives, forcing users to those expensive iPhones.

What the Lawsuit Says

According to the Department of Justice, Apple is engaging in anti-competitive behavior and they are pinning their focus on Apple’s best-selling product, the iPhone. DoJ argues that Apple’s actions have harmed users and Apple acted in bad faith to maintain monopoly and collect rental income from monopolistic control.

What are Apple’s actions that the DoJ mentioned? Here’s what was mentioned:

- No 3rd-party app store: To install new software on the iPhone, you can only do it through an Apple-controlled App Store where the rules governing it are applied arbitrarily. Furthermore, Apple did some actions that impeded certain apps from appearing on the App Store because that apps might threaten Apple’s dominance

- Super apps suppression: The kinds of apps that we put on focus in the super apps, an app that has a multitude of mini-apps that make portability between iPhone and Android (Apple’s main competitor) easier.

- No 3rd-party wallet: To use your smartphone as your credit card, there’s no 3rd-party wallet option. There’s only Apple Wallet which Apple takes a cut and controls the behavior

- Choosing Google as the default search engine: This action is not illegal per se, but the DoJ argues that despite Apple’s advertising themselves to be privacy-centric, Apple sells user information or allows other companies like Google to collect data while accepting billions.

Overall, DoJ is charging Apple with section 2 of the Shermat Act which reads:

… makes it unlawful for any person to “monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations …

Facts

From reading the 80-page lawsuit, here are the facts that we gleaned:-

- Apple makes a lot of money: In 2023, Apple generates more than $1 billion per day. Its net income (after paying taxes, costs, etc) is larger than the GDP of over 100 countries in the world.

- Apple owns the smartphone market in the USA: Apple might sell fewer phones than its competitors, but makes more money from it. 70% of revenue sales of high-end smartphones is owned by Apple. Apple overall owns 65% of revenue.

- It’s more dominant in the younger segment: Samsung, Apple’s closest competitor only managed to secure a 10% market share. Apple is 30%. In a survey, 88% of teens will buy an iPhone

- Apple is a gatekeeper on the iPhone: The DoJ accused Apple of stifling cross-platform tech on the iPhone (unlike Macs). Apple invites 3rd-party developers to build apps on the iPhone (and by extension, iPadOS, tvOS, and family of devices) but imposes tight and arbitrary rules.

- No reasonable alternatives: The DoJ argues that most of the iPhone functionality can be duplicated on web apps, but with users can’t find their way to web apps, there’s no decent alternative.

- Locked functionality for the sake of control: DoJ argues that Apple limits access to developers on iPhone for important functionality that they think it ought to make public. For one, SMS messages can only be received through Apple’s Messages app. You can only use Apple’s Safari app to visit websites.

DoJ’s three-point bullet

DoJ argues that Apple unlawfully maintains its monopoly power. Their three major points are

- App Store: Apple controls app distribution and app creation

- Moat building: Apple pushes consumers away from apps or products that threaten Apple’s dominance

- Rent-seeking behavior: Through the monopoly and controls, Apple uses that to extract rent monopoly. These actions include taking a 30% cut of every transaction, charging developers to make it easier for user to find their apps

App Store

The major point of contention is that the App Store is controlled by Apple, but Apple is using the App Store to control how things work in the iPhone. Here are what the DoJ is accusing Apple of

The major problem is Apple sees it as a threat because those apps are portable, meaning that it does not make a difference between Android and Apple iPhone. That means people can easily switch between Android and iPhone. The DoJ argues that Apple took steps to make super apps unattractive by imposing arbitrary rules upon them while not enforcing those rules on other single-use apps.

Cloud gaming: apps are being prevented from running on the iPhone. Most of the processing is done on the cloud, which negates the need for powerful hardware which is expensive. Another reason is the app is just a shell which makes it easier for developers to make it a version for iOS or Android. That ease of portability is what threatens Apple.

Rent Seeking behavior

It’s well known that Apple takes a 30% cut on any transaction made using the App Store. It seems to be an accepted practice since Apple owns the App Store, bears the cost of running it, and maintains the platform that is the iPhone.

DoJ takes issue because Apple is exerting monopolistic control over the iPhone through the App Store and charges rent for its use of it. And what’s more important, there’s no alternative for developers and users not to use Apple’s way.

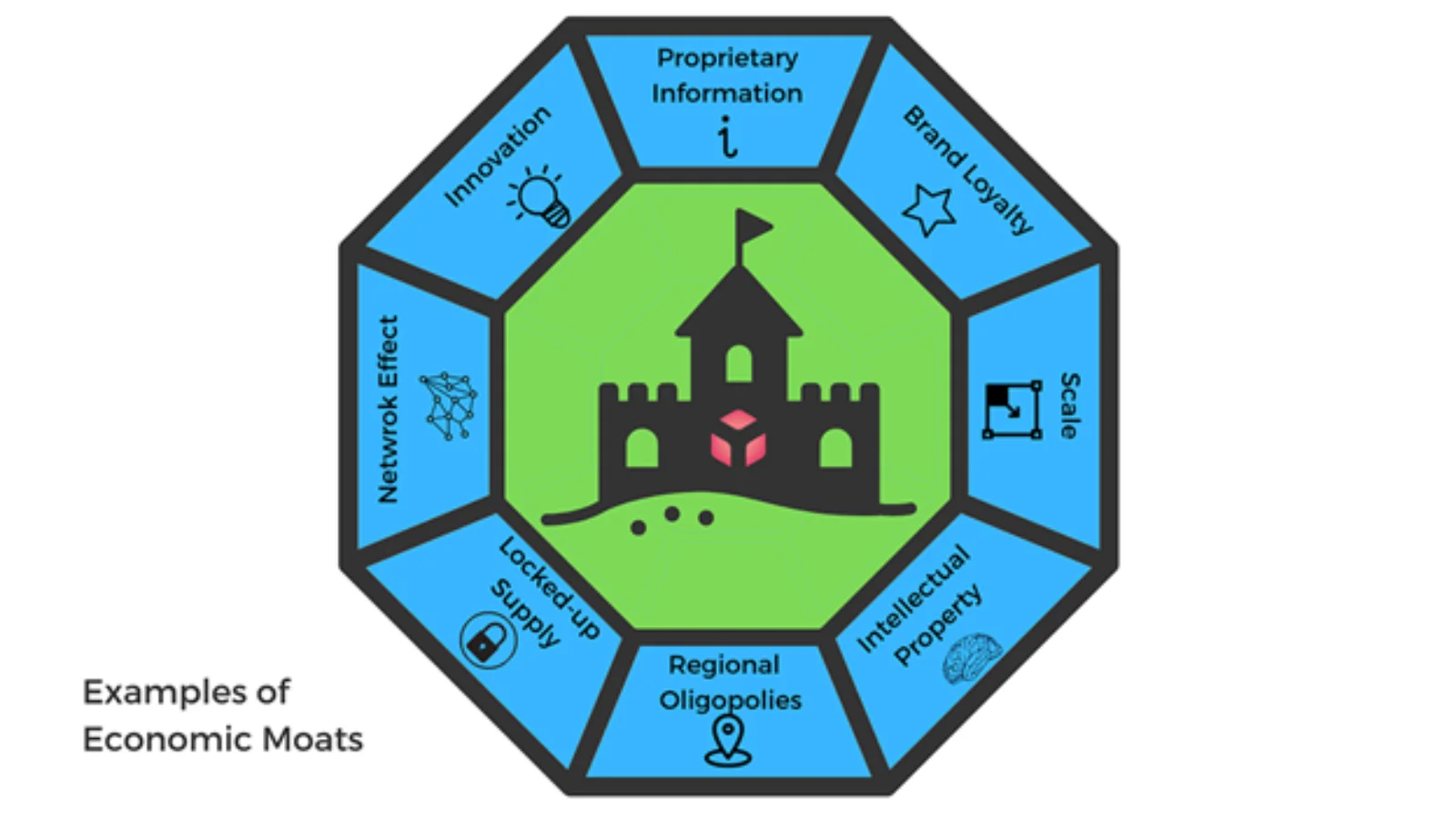

The moat

In business, there’s the concept of the castle and the moat. The moat is a free business or service that keeps people in the ecosystem and the castle is the one generating the reviews. For Google, the moat is their excellent search engine and free-to-view YouTube videos and the castle is the ad placement that gets peppered on the service.

Apple’s moat is the ecosystem. Users will buy Apple products knowing that their products work well together. Apple also offers free services within their ecosystem like iMessage and FaceTime and also paid services like Apple TV+, iCloud Storage, and so on. So far it’s fine.

What’s not fine according to DoJ is the measures Apple took to ensure people are in the moat. DoJ accused Apple of blocking apps that can harm their dominance like super apps and cloud gaming. DoJ also accused Apple of gatekeeping their core tech like keeping iMessage on the iPhone and being slow to implement open standards like RCS. There’s this famous interview where someone asked Tim Cook, the CEO about iPhone-Android messaging interoperability, and Tim Cook, smugly said “Buy your mom an iPhone”. That got quoted in the lawsuit.

One of the complaints that the DoJ said is that there’s no existence of 3rd party virtual wallet apps because Apple makes the necessary APIs for it private. In the USA, Apple charges a 0.15% cut for every transaction made through Apple Pay, Apple’s virtual wallet solution. Apple facilitated a $200 billion transaction in 2023 just in the US alone. Do the math.

Conclusion

For a very long time, Apple has been well-known for taking a wall-garden approach to selling its products. Macs are great products and work better with other Apple products. The iPhone takes this approach to the next level where Apple Watch only works on iPhones and AirPods works best with other Apple products. If this method is right or wrong, it will be the courts to decide it.

The results of this lawsuit will be years from now, but make no mistake, Apple will no longer work as it. Maybe it’s a good thing as Microsoft was hit with a DoJ lawsuit back in the late 1990s and that changed Microsoft. Maybe it will do the same for Apple.

Updates

On August 2024, Apple filed a motion to dismiss DOJ Anti-trust lawsuit. Some of Apple’s argument in the filing:

Message is Apple’s proprietary, innovative messaging service that Apple created to competitively differentiate iPhone. Under the Government’s view, companies like Apple should face antitrust liability for not expending the resources, cost, and time to develop versions of proprietary products and services for competitors’ devices.

It is implausible to claim, as the Government does, that Apple has deterred any customers from switching to Google or Samsung because of its policies with respect to “super apps,” cloud gaming, smartwatches, or anything else. The opposite is much more plausible: Users unhappy with Apple’s reasonable policies on third-party access can and do switch away to competitors’ devices, where those limits do not exist.

Plug

Support this free website by visiting my Amazon affiliate links. Any purchase you make will give me a cut without any extra cost to you

| Base | Pro | |

|---|---|---|

| iPhones | iPhone 16 / iPhone 16 Plus - (Amazon) | iPhone 16 Pro / iPhone 16 Pro Max - (Amazon) |

| Watch | Apple Watch SE (Amazon) / Apple Watch Series 10 | Apple Watch Ultra 2 (Amazon) |

| AirPods | AirPods 4 (Amazon) | AirPods Pro 2 (Amazon) / AirPods Max (Amazon) |

| iPad | iPad 10 (Amazon) / iPad Mini (Amazon) | iPad Air M2 (Amazon) / iPad Pro M4 (Amazon) |

| Laptops | MacBook Air M3 (Amazon) | MacBook Pro M3 (Amazon) / MacBook Pro M3 Pro/Max (Amazon) |

| Desktop | Mac Mini (Amazon) / iMac (Amazon) | Mac Studio / Mac Pro |

| Displays | Studio Display (Amazon) | Pro Display XDR (Amazon) |

Other Ecosystem Items